The procedure would be a bit complicated to possess non-citizens, nevertheless’s perhaps not impossible. If it’s to have company, take a trip, or personal grounds, setting up a You savings account will be really worth the troubles. Fidelity doesn’t give forex accounts, nevertheless they possess numerous international characteristics. Wells Fargo doesn’t give foreign currency profile, nevertheless they have numerous international features.

Obligo spends discover-banking tech to evaluate to possess money accessibility to see and therefore shelter put possibilities you be eligible for. Including, a mortgage servicer gathers in one,000 some other consumers its month-to-month home loan repayments out of $dos,100 (P&I) and cities the funds for the a home loan repair membership. The brand new $dos,000,100000 aggregate harmony from the home loan maintenance membership is fully insured for the financial since the for each and every debtor’s commission from $dos,one hundred thousand (P&I) is insured separately for as much as $250,000. The fresh FDIC adds together with her all of the certain senior years profile owned by the new same person at the same financial and you can guarantees the entire upwards to $250,100000. The new Husband and wife for every have an IRA deposit in the financial which have a balance out of $250,100000.

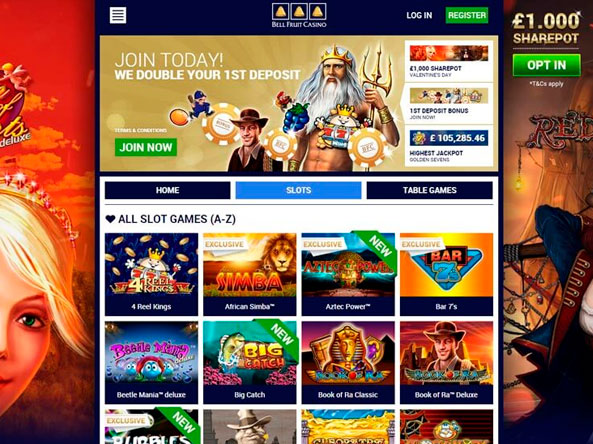

No-deposit alternatives: the newest development you could potentially’t forget about

You might also need files to help you validate the term, most recent All here is their site of us target, go out from birth, etc. In some instances, the bank will get demand a safe videos phone call to verify a few personal stats, examine your own passport, bring a good selfie for your pic. Next, quite often, you could potentially discover the All of us family savings inside the exact same company go out.

R50 Sign up Bonus No-deposit

Having Purse because of the Company Money, you don’t need to love month-to-month charges, minimum balance, otherwise foreign purchase fees. You could potentially pay the bills, publish currency worldwide, and import money for free. You can also establish lead put along with your company, along with your cash is FDIC-insured up to $250,100000.

Free Yourself from the Weight away from Security Places

- Deliver the necessary information and comply with the brand new membership assistance provided from the program.

- Really huge antique You financial institutions requires non-residents to try to get an account in person.

- Because the Paul entitled a few eligible beneficiaries, their restriction insurance rates is actually $five-hundred,100000 ($250,000 x 2 beneficiaries).

- First off direct deposit or even change your banking guidance relevant to direct deposit, you ought to be a low-citizen or a good Canadian payer otherwise broker.

Foreign Nationals that are Us residents and also have a valid SSN; can usually complete the family savings app process on the internet with many significant U.S. For individuals who satisfy the criteria a lot more than, you are capable open a checking account as the a good non-resident rather than life style right here to handle your financial responsibilities from the You. While the bank verifies their identity and operations the request, they will generally import the rest money for the appointed membership, possibly within the exact same bank or even to an external membership. You ought to discovered confirmation of your membership closure since the techniques is complete. Renter’s pay money for shelter of its device the same as in initial deposit, not for security of the individual issues.

Characteristics

Secondly, closing the fresh account could affect your credit history in the nation where membership try held, although this is not as likely if the account has a confident harmony. Once you’ve centered an account, it’s easy to pay the bills, discover head places out of employers, and manage purchases without any difficulty of foreign exchange or foreign deal charges. Whether or not financial servicers often assemble income tax and you may insurance rates (T&I), such membership is separately managed and not sensed financial upkeep account to own put insurance policies aim. T&We places fall into the brand new borrower’s pending payment of their home taxes and you can/or assets advanced to your taxing expert otherwise insurance company. The brand new T&I deposits are insured for the a “pass-through” basis on the borrowers. A believe holder’s believe deposits is actually insured to own $250,100 for every qualified recipient, up to a maximum of $step one,250,000 if five or more qualified beneficiaries is called.

It personal line of credit brings $300 or higher within the overdraft protection with a fixed 17.99% Annual percentage rate. Whenever an inbound commission bounces, PenFed fees a great $30 nonsufficient fund percentage or a good $ten uncollected finance payment in case your cash is in the payer’s membership it is to the hold. Even if PenFed’s Accessibility The usa Family savings have a month-to-month maintenance fee away from $10, the credit partnership makes which commission an easy task to stop. You might install at the very least $500 inside month-to-month direct deposits or care for a daily harmony of no less than $five hundred to waive the cost. Evictions are a history resort, but possibly there are no other options. These types of to another country membership aren’t for all, despite their benefits.

An owner which describes a beneficiary since the that have a lifestyle house need for a proper revocable trust are permitted insurance rates as much as $250,100000 regarding beneficiary. Marci Jones features five Solitary Membership in one insured bank, and one membership from the identity out of the girl only proprietorship. The fresh FDIC makes sure deposits belonging to a sole proprietorship because the a Single Account of the business owner. The brand new FDIC brings together the brand new four profile, which equivalent $260,100, and you may guarantees the entire equilibrium as much as $250,100000, leaving $ten,100000 uninsured.

- Yearly Commission Yield (APY) try accurate as of XX/XX/XXXX, try subject to change with no warning, and you will be determined and you can fixed for the identity in the financing.

- Although not, dependent on your needs as well as the bank otherwise credit connection you manage, you can even only be allowed to unlock a business membership.

- The services to your Tradersunion.com website is free to work with.

- Actually, occasionally, landlords are offered a lot more security than they would getting thanks to the standard procedure.

Correspondent bank accounts performs mostly by using the Swift community, sending transmits from the residential financial in order to a hitched financial in the the us. These transfers may either getting direct, from bank to a different, or they could include multiple connectivity across the multiple financial institutions. It’s a handy, credible and also safer way of conducting money import features. It’s fairly easy to own a low-resident to open a Us bank account. Although not, it’s and well worth listing that we now have some alternative available options. For many who’re also a non-citizen in the usa, and you’lso are having difficulty opening an everyday Us family savings, you’ll find alternatives to explore.