The fresh difference to be the original exchange-replaced money is usually provided to the fresh SPDR S&P 500 ETF (SPY) released by the State Path Worldwide Advisers to your Jan. 22, 1993. There had been, although not, specific precursors so you can SPY, as well as Index Participation Systems listed on the Toronto Stock-exchange (TSX), and therefore tracked the brand new Toronto thirty-five List and starred in 1990. You will find ten ETFs focused on businesses engaged in gold exploration, leaving out inverse and you can leveraged ETFs and people which have relatively reduced property lower than government (AUM). AMBCrypto’s content is meant to be educational in general and ought to not translated as the investment advice. Trade, selling cryptocurrencies should be thought about a premier-exposure financing each reader is preferred to do their own look before making people decisions. You can expect suggestions that have ETF reviews, profile steps, profile simulations and you will investment books.

Design and framework from ETFs – IQ Option strategy tools

ETFs are tempting, specifically to help you student people, because they enables you to very own an excellent diversified portfolio with an excellent unmarried funding unit. Most ETFs are designed to track a certain industry or list, like the S& IQ Option strategy tools amp;P five-hundred or TSX Substance Directory. Thematic ETFs are composed from a profile out of brings one portray a particular theme or trend. He is made to tune a particular funding theme, for example intercourse assortment otherwise development otherwise robotics and you can cybersecurity. Including, a great thematic ETF focused on intercourse range may only invest in enterprises in which no less than twenty-five% out of board players are females.

Dividends on the ETFs

They generally go after basic habits such list ETFs, bonus ETFs or low volatility ETFs and you will behave like an inactive list ETF, albeit with yearly, semi-annual, or every quarter rebalancing. He has lower MERs than a definitely treated ETF however, higher MERs than traditional ETFs. Just like any funding, it’s imperative to remain told, see the dangers, and continuously reassess your means within the light of the financing objectives and you will altering industry criteria. Which have mindful planning and you will wise decision-and then make, ETFs will be a very important part of your investment profile. Tactical advantage allotment comes to periodically modifying the brand new blend of property inside your portfolio based on market conditions and you may financial predicts.

ETFs will likely be ultra-greater inside desire, trying to tune an over-all business list like the S&P five hundred, and/or efficiency away from an entire country’s cost savings. They could be also ultra-narrow inside desire, focusing for the a tiny number of organizations in one single subsector. Just after setting goals and you will contrasting ETFs, wade better to learn more about just how for each ETF compares on the secret metrics, and results, chance, costs, and you can key holdings. And also then, the original thrill can easily seek out worry if the stock you choose doesn’t perform well. Prior to investing people ETF, constantly remark the prospectus and relevant documents to gain a standard comprehension of their requirements, threats, charges, or other services. Such work on technical, health care, energy, and other parts of the brand new economy.

This article is provided with Federal Financial Head Brokerage (NBDB) for advice aim only. It will make zero legal or contractual obligation to possess NBDB as well as the specifics of this particular service offering plus the criteria herein is actually subject to change. The message associated with the Webpages emerges to own standard information aim and should not be interpreted, experienced or made use of because if it was monetary, judge, financial, or other information by any means. Concurrently, the material on this site, whether monetary, financial or regulatory, may possibly not be legitimate beyond your province away from Quebec. Another factor worth considering is the complete part of holdings one the top ten holdings represent.

The outcomes of having each one try effectively a comparable inside the the future. It means the portfolios just make an effort to simulate the new holdings and chance characteristics away from a specific list because the directly to. It means holding the same securities while the benchmark within the similar proportions.

- Extremely brokerages often costs a payment fee (always $10 otherwise reduced) when you get or sell an enthusiastic ETF.

- Inventory places try unstable and can vary rather as a result to help you team, community, political, regulating, industry, otherwise economic developments.

- List fund is actually the most preferred, making-up more cuatro/5s of the possessions less than administration in the You.S.

- Tactical investment allocation involves periodically adjusting the fresh blend of possessions within the your own collection centered on business criteria and you can economic forecasts.

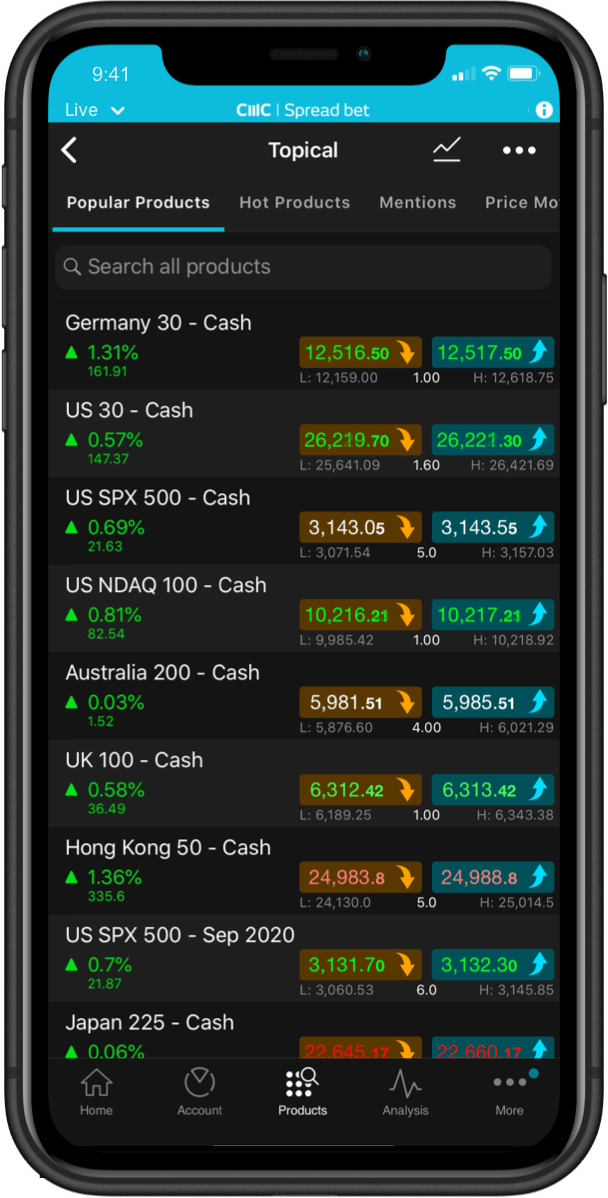

- ETFs are listed on personal transfers, and you may purchase and sell her or him while in the field instances just including brings.

What the development method for your bank account, in addition to tips to make it easier to invest, rescue, and you may invest. Remain related to iShares and discuss extra tips built to help you realize your financial desires. Whether your’re also trying to build wealth, or even merely cut back to own a secondary, iShares ETFs makes using as easy as going for a great playlist of music. And so they’re clear — Enabling you to see just what you own and sustain your asset allocation down.

The fresh contrast tool breaks down every piece of information to the 4 parts revealed alongside, the original as being the evaluation which aside from delivering a bona-fide day quotation and shows the new benchmark, net possessions of one’s ETF as well as the administration percentage. Country-specific ETFs work with a certain country or city such Canada or Europe. Over the past twenty years, ETFs provides switched just how advantages and folks access funding possibilities, as a result of the self-reliance and you may ease of access.

Passive ETFs usually standard and you will imitate the brand new way from a directory like the TSX, the brand new S&P 500, or movement inside a particular market such gas and oil or biotech. In the first place most ETFs had been passive and never earnestly handled – to the purpose of reproducing while the diligently that you can the underlying index at the cheapest. Replace traded money (ETFs) was first created in the new 1990s as a way to render personal traders entry to couch potato, indexed finance.

The brand new HSBC FTSE UCITS ETF is actually on the London Stock Change and deals within the ticker icon HUKX. The new ETF provides a continuous fees from 0.07% and you may a bonus produce of step three.56% since April 2025. Past reports brought winners including Application (+97.3%) and you can POWL (+61.8%) within 30 days.

What’s the Difference in a keen ETF and you can a mutual Financing?

The level of redemption and you can production activity is actually a function of consult in the market and you can if the ETF is actually exchange at the a discount or advanced to the worth of the newest fund’s possessions. IShares aren’t offers from a buddies, he could be devices of a financing and this holds a collection customized to closely tune the newest performance from a selected market directory. IShares ETFs change on your local stock market in the same way while the offers of any societal organization. Fidelity isn’t indicating otherwise promoting it financing by making they accessible to the customers. Prior to making any investment decisions, you need to consult your individual top-notch advisors or take to your membership all of the kind of things and things of one’s individual condition.

What is A keen ETF (EXCHANGE-Traded Fund)?

In case of case of bankruptcy, a businesses creditors bring precedence more than the stockholders. Play with all of our screener to spot ETFs and you will ETPs one match your money requirements. Since the ETFs is actually premade financing, you don’t get a state with what they invest in. So if you love to invest in confirmed finance, make certain that you’re comfortable and invested in gaining exposure to all the those securities. These incorporate the new 100 premier in public areas noted enterprises regarding the nation.

The first step to use the new contrast equipment should be to have a listing of ETFs, We ran in the future and you will used the ETF screener to incorporate a great list of energetic & inactive Canadian guarantee ETFs. Here’s all you have to know about ETFs and why very of numerous investors is drawn to him or her. Variation and you will asset allotment don’t make certain a return otherwise make sure facing losses. That said, you will be able to own an enthusiastic ETF to combine elements of couch potato and energetic, such as when the a fund pursue a custom directory. ETFs can be somewhat confusing when you look deep to the everything, but also for what the mediocre investor enjoy, they are usually easy to see and trade. Rates can be influenced by various financial, financial, public and you will governmental things, which are unstable and could has a serious influence on the costs from commodities.

ETFs are pooled money vehicle offering investors the ability to achieve varied contact with a general set of possessions, for example brings or securities. Rather than antique shared financing, although not, ETFs is actually exchanged to your big inventory exchanges, and therefore ETF shares are available to be bought and you may ended up selling whenever the marketplace is discover. Alternatively, a broker generally encourages trade purchases between investors and you will the new shared fund organization, or you could interact personally on the shared money business.